Essay

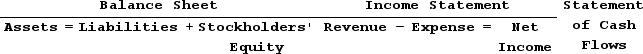

Gladding, Incorporated applies the lower-of-cost-or-market rule to the entire stock of its inventory in the aggregate. At the end of the accounting period, it is determined that the cost of the inventory is $26,985 and the market (replacement)value is $25,886. Indicate how the required adjustment affects the elements of the financial statements. Use the following letters to record your answer in the box shown below. If an event increases one account and decreases another account within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts.Increase = IDecrease = DNot Affected = NA

Correct Answer:

Verified

Because the market value of the entire ...

Because the market value of the entire ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: A company's gross margin reported on the

Q39: Vargas Company uses the perpetual inventory system

Q64: The cost flow method chosen by a

Q93: Singleton Company's perpetual inventory records included the

Q115: Steven, Incorporated uses the perpetual inventory system.

Q117: The inventory records for Radford Company reflected

Q118: If Bowman Company is using FIFO and

Q121: In an inflationary environment, which inventory cost

Q124: The following information is for Lattimore Company

Q125: Chase Company uses the perpetual inventory method.