Essay

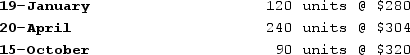

Max Company's first year in operation was Year 1. The following inventory purchase information comes from Max's accounting records for the year:

In December Year 1, Max sold 350 units for $480 each. Operating expenses for the year were $30,000, and the tax rate was 30%.

In December Year 1, Max sold 350 units for $480 each. Operating expenses for the year were $30,000, and the tax rate was 30%.

Required:a)Calculate the cost of goods sold using LIFO.b)Calculate the cost of goods sold using FIFO.c)What amount of income tax would Max have to pay if it uses LIFO?d)What amount of income tax would Max have to pay if it uses FIFO?e)Assuming that the results for Year 2 are representative of what Max can generally expect; would you recommend that the company use LIFO or FIFO? Explain.

Correct Answer:

Verified

a)$107,360b)$103,520c)$9,192d)$10,344e)B...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: What are the circumstances that might cause

Q56: Carson Company has an inventory turnover of

Q57: Stubbs Company uses the perpetual inventory method

Q58: Chase Company uses the perpetual inventory method.

Q61: The following transactions apply to Sam's Skateboards.<br>

Q62: The adjusting entry to recognize the write

Q63: Diaz Company's first year in operation was

Q64: Poole Company purchased two identical inventory items.

Q67: Phipps Corporation overstated its ending inventory on

Q81: During a period of declining prices,a company