Essay

Jones Company sells exercise bikes. Its beginning inventory was 100 units at $200 per unit. During the year, Jones made two purchases of the bikes: first, a 300-unit purchase at $220 per unit, and then 200 units at $250 per unit. The ending inventory for the year was 250 units.

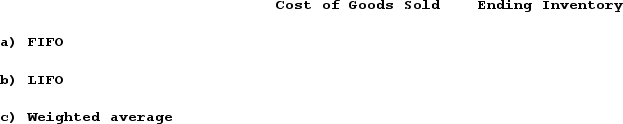

Required:Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Jones uses each of the following inventory cost flow methods:a)FIFOb)LIFOc)Weighted average(Round intermediate calculations to two decimal places. Round final answers to whole dollars.)

Correct Answer:

Verified

Average cost per unit: [(100...

Average cost per unit: [(100...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: When using the gross margin method to

Q31: West Corporation's Year 1 ending inventory was

Q73: Chase Company uses the perpetual inventory method.

Q76: Ignoring the impact of income tax, how

Q78: The inventory records for Radford Company reflected

Q81: Landis Company is preparing its financial statements.

Q82: In an inflationary environment, which inventory cost

Q84: During a period of rising inventory prices,the

Q90: Explain the computation of and the significance

Q93: Singleton Company's perpetual inventory records included the