Essay

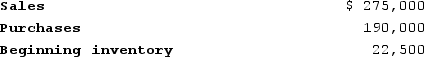

Byrne Company had its entire inventory destroyed when a fire swept through the company's warehouse on April 30, Year 2. Fortunately, the accounting records were locked in a fireproof safe and were not damaged. The following information for the period up to the date of the fire was taken from the accounting records:

Required:Assuming that the gross margin has averaged 35%, what is the estimated value of the inventory destroyed in the fire?

Required:Assuming that the gross margin has averaged 35%, what is the estimated value of the inventory destroyed in the fire?

Correct Answer:

Verified

Correct Answer:

Verified

Q66: What accounting steps would a firm normally

Q85: Misty Mountain Outfitters is a merchandiser of

Q87: Assume a company paid $1,000 for a

Q88: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8394/.jpg" alt=" What is the

Q92: The LIFO cost flow method assigns the

Q93: Singleton Company's perpetual inventory records included the

Q93: Singleton Company's perpetual inventory records included the

Q94: Melbourne Company uses the perpetual inventory system

Q95: Anton Company uses the perpetual inventory system

Q109: List the specific steps used in computing