Essay

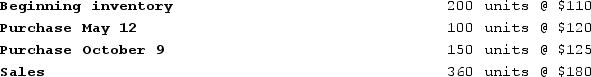

The following information relating to the current year was taken from the records of Poole Company:

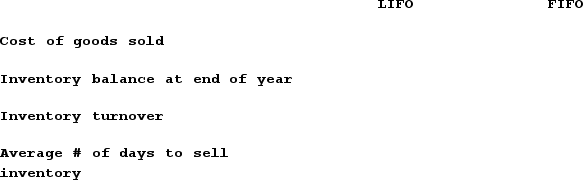

Required:a)Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to cost of goods sold, and how much to inventory at the end of the year.b)Based on your results from part (a), calculate inventory turnover and average number of days to sell inventory.c)Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to inventory at the end of the year.d)Based on your results from part (c), calculate inventory turnover and average number of days to sell inventory.e)Compare your results from parts (b)and (d). Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

Required:a)Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to cost of goods sold, and how much to inventory at the end of the year.b)Based on your results from part (a), calculate inventory turnover and average number of days to sell inventory.c)Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to inventory at the end of the year.d)Based on your results from part (c), calculate inventory turnover and average number of days to sell inventory.e)Compare your results from parts (b)and (d). Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

Correct Answer:

Verified

a)through d)

e)LIFO and FIFO do not gi...

e)LIFO and FIFO do not gi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: The following transactions apply to Sam's Skateboards.<br>

Q62: The adjusting entry to recognize the write

Q63: Diaz Company's first year in operation was

Q64: Poole Company purchased two identical inventory items.

Q65: Chase Company uses the perpetual inventory method.

Q67: Howard Company uses the perpetual inventory system.

Q68: How does the physical flow of goods

Q69: A company uses a cost flow method

Q70: Chase Company uses the perpetual inventory method.

Q71: What ratio (usually an average from prior