Essay

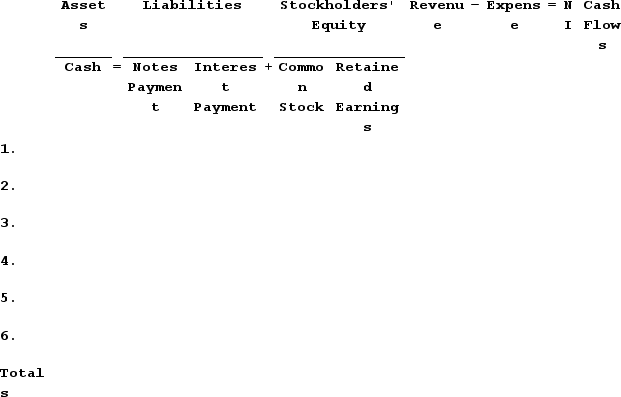

Osage Corporation began business operations and experienced the following transactions during Year 1:

1)Issued common stock for $25,000 cash2)Issued a $20,000, 6% 4-year note to the bank on February 13)Provided services to customers for $80,000 cash4)Paid $38,000 for operating expenses5)Accrued interest expense on the note6)Paid a $4,000 dividend to shareholders

Required:Record the above transactions on a horizontal financial statements model to reflect their effect on Osage's financial statements. In the last column, enter OA, IA, FA for the type of cash flow activity, or NA if there is no activity.

Correct Answer:

Verified

Accrued Interest Expense = $20,000 note...

Accrued Interest Expense = $20,000 note...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Oregon Company began operations on January 1,

Q21: Nelson Company experienced the following transactions during

Q22: Indicate whether each of the following statements

Q23: Fancy Foods Incorporated had an ending balance

Q24: Which of the following is an asset

Q26: The balance in accounts receivable represents the

Q27: Accounts payable is reported on the income

Q28: The primary difference between notes payable and

Q29: Indicate whether each of the following statements

Q30: Indicate how each event affects the elements