Essay

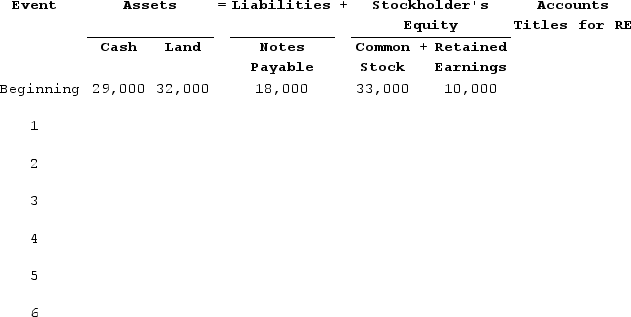

At the beginning of Year 2, the accounting records of Grace Company included the accounts and balances shown on the first row of the table below. During Year 2, the following transactions occurred:Received $95,000 cash for providing services to customersPaid salaries expense, $50,000Purchased land for $12,000 cashPaid $4,000 on note payablePaid operating expenses, $22,000Paid cash dividend, $2,500Required:a)Record the transactions in the appropriate accounts. Record the amounts of revenue, expense, and dividends in the retained earnings column. Enter 0 for items not affected. Provide appropriate titles for these accounts in the last column of the table. (The effects of the first event are shown below.)

b)What is the amount of total assets as of December 31, Year 2?c)What is the amount of total stockholders' equity as of December 31, Year 2?

b)What is the amount of total assets as of December 31, Year 2?c)What is the amount of total stockholders' equity as of December 31, Year 2?

Correct Answer:

Verified

a)

b)What is the amount of t...

b)What is the amount of t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: The financial statements of Calloway Company prepared

Q13: Lexington Company engaged in the following transactions

Q14: Which of the following is the most

Q16: Packard Company engaged in the following transactions

Q19: Jackson Company paid $500 cash for salary

Q20: Montgomery Company experienced the following events during

Q21: Young Company reported the following balance sheet

Q21: Which of the following is an example

Q29: Give three examples of asset use transactions.

Q99: Name and briefly describe each of the