Essay

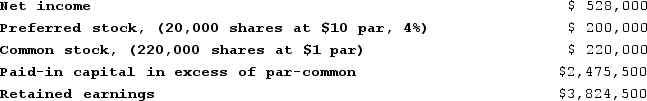

The following information was provided by Joseph Company as of December 31, Year 2:

On the most recent trading date, Joseph's common shares sold at $36 and the preferred shares sold at $14.

On the most recent trading date, Joseph's common shares sold at $36 and the preferred shares sold at $14.

The following information on industry averages is provided:

Earnings per share $2.06

Price-earnings ratio 13.2:1

Required: 1)Calculate Joseph Company's (a)earnings per share and (b)price-earnings ratios. Round your answer to two decimal places.2)Discuss whether you would invest in this company.

Correct Answer:

Verified

Answers will vary.1)(a)$2.36

Earnings pe...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Earnings pe...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: The following information applies to Acorn Construction

Q4: The following information applies to Markham Company:<br>

Q7: In vertical analysis of a balance sheet,

Q9: The following balance sheet information was provided

Q10: When debt is used to finance the

Q10: Various ratios are computed to assess different

Q11: Short-term creditors are usually most interested in

Q11: The following balance sheet information is provided

Q36: Discuss the limitations that affect financial statement

Q48: A limitation of financial statement analysis stems