Essay

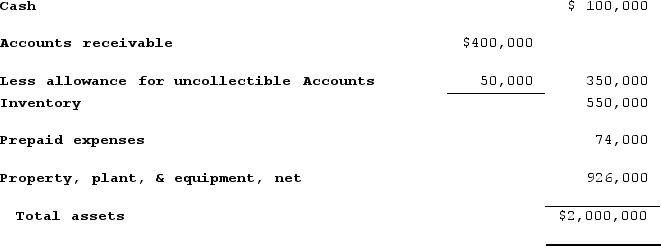

Longwood Company had a current ratio of 3:1 at the end of Year 1. The asset section of the company's balance sheet is provided below:

Required:1)Compute Longwood Company's end-of-year working capital.2)Compute the company's quick (acid-test)ratio.3)The company has a debt agreement with its bank that authorizes the bank to call in its loan to the company if the company's current ratio falls below 3:1 as of the last day of any month during the term of the loan. During January Year 2, the company engaged in the three following transactions:(a)Collected $100,000 on account;(b)Purchased inventory on account, $50,000(c)Paid accounts payable, $60,000Will the company be in default after completing these transactions? Justify your answer.

Required:1)Compute Longwood Company's end-of-year working capital.2)Compute the company's quick (acid-test)ratio.3)The company has a debt agreement with its bank that authorizes the bank to call in its loan to the company if the company's current ratio falls below 3:1 as of the last day of any month during the term of the loan. During January Year 2, the company engaged in the three following transactions:(a)Collected $100,000 on account;(b)Purchased inventory on account, $50,000(c)Paid accounts payable, $60,000Will the company be in default after completing these transactions? Justify your answer.

Round your answers to two decimal places.

Correct Answer:

Verified

Answer to part c will vary.1)$716,000

Cu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Cu...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Miller Company reported gross sales of $850,000,sales

Q29: Which of the following statements about financial

Q73: Financial statement analysis involves forms of comparison

Q105: Phips Company paid total cash dividends of

Q146: Which of the following statements regarding net

Q147: The following balance sheet information was provided

Q148: Which of the following is (are)objective(s)of ratio

Q151: Alpha Company provided the following balance sheet

Q153: Indicate whether each of the following statements

Q154: Working capital is defined as:<br>A)Current assets divided