Multiple Choice

Use the following to answer questions:

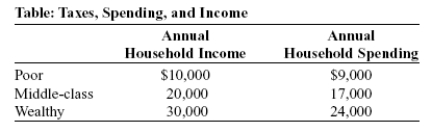

-(Table: Taxes, Spending, and Income) Look at the table Taxes, Spending, and Income. Suppose Governor Meridias decides to initiate a state tax of 5% on all sales. A poor household will spend _____ of its annual income on the sales tax, while a wealthy household will spend _____ of its annual income.

A) 4.5%; 4%

B) 5%; 5%

C) 5%; 3.5%

D) 3.5%; 4.5%

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A regressive tax takes a:<br>A)fixed percentage of

Q107: In the United States,poor people and the

Q182: If the marginal tax rate equals the

Q188: Under what supply and demand conditions would

Q189: A tax system achieves equity when:<br>A)taxes are

Q190: Use the following to answer questions:<br>Figure: The

Q191: By law, FICA (the Federal Insurance Contributions

Q194: If demand and supply are both very

Q215: The burden of a tax on a

Q282: Suppose an income tax is levied on