Multiple Choice

Use the following to answer questions:

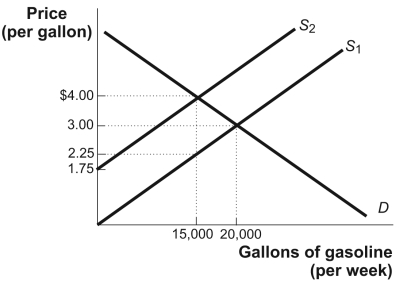

Figure: The Gasoline Market

-(Figure: The Gasoline Market) Look at the figure The Gasoline Market. The pretax equilibrium price is $3, and the equilibrium quantity before tax is 20,000 gallons. An excise tax has been levied on each gallon of gasoline, shifting the supply curve upward. The deadweight loss from this tax is equal to:

A) $1.50.

B) $5,000.

C) $15,000.

D) $4,375.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: An analysis of the effect of excise

Q40: Suppose the government imposes a $4 per

Q99: The benefits principle of taxation means individuals

Q112: An excise tax is levied on:<br>A)each unit

Q122: The benefits principle says that:<br>A)the amount of

Q208: Use the following to answer questions:<br>Figure: A

Q212: Which of the following taxes reflects the

Q212: Prior to any taxes,the equilibrium price of

Q215: Explain how an excise tax levied on

Q235: A tax that takes a higher percentage