Multiple Choice

Use the table below to answer the following question(s) .

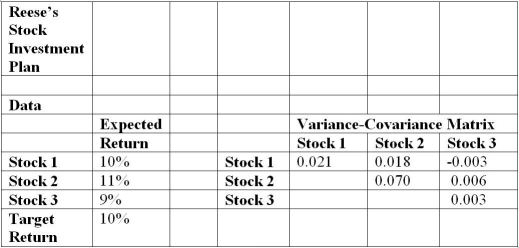

Jonathan Reese is considering three stocks in which to invest with a fixed budget.The table below provides information on Jonathan's expected returns for each stock.The table also provides information, collected from market researchers, on the variance-covariance matrix of the individual stocks.He expects a total return of at least 10%.

Develop a quadratic optimization model to find the optimal allocation of the budget to each stock, and variance calculations for squared terms and cross-products based on the variance-covariance matrix.

-According to the model, what is the expected variance of the resulting portfolio?

A) 0.014

B) 0.010

C) 0.009

D) 0.012

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Use the table below to answer

Q11: Use the table below to answer

Q12: Use the table below to answer

Q13: A global optimum solution is one for

Q14: Absolute value functions, in optimization models, result

Q16: Use the table below to answer the

Q17: Use the table below to answer the

Q18: Use the table below to answer

Q19: Pickson Luthiers Corporation is studying where to

Q20: Use the table below to answer