Multiple Choice

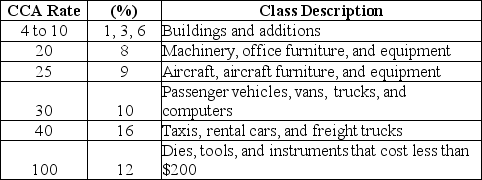

Sample CCA Rates and Classes are presented as follows:  What does the number "20" in the CCA Rate column mean?

What does the number "20" in the CCA Rate column mean?

A) A firm can claim a 20% depreciation rate per year for an asset such as machinery, office furniture, and equipment during its service life.

B) A firm can claim a 20% depreciation rate per year for an asset such as machinery, office furniture, and equipment beginning in the second half of the year after purchase of that asset.

C) A firm can fully depreciate an asset such as machinery, office furniture, and equipment in 5 years from the time it is purchased using the depreciation rate of 20% per year.

D) A firm can claim a 20% depreciation rate on half of the capital cost of a new asset such as machinery, office furniture and equipment in the year of purchase of that asset, while the other half is included in the following year.

E) A firm can only depreciate an asset such as machinery, office furniture, and equipment with the rate of 20% in the first year of purchase of that asset.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: SHMON Inc. wants to invest in future

Q27: Explain the problem of "writing-off" and how

Q28: Why do businesses want to depreciate their

Q29: A tax is progressive if<br>A)the rate of

Q30: An asset is purchased for $100 000.

Q32: The capital tax factor (CTF)is a value

Q33: SINCO Ltd. purchased a piece of equipment

Q34: The before-tax MARR is<br>A)higher than the after-tax

Q35: An engineering construction company purchased an excavator

Q36: Numerically the relationship between the CTF and