Multiple Choice

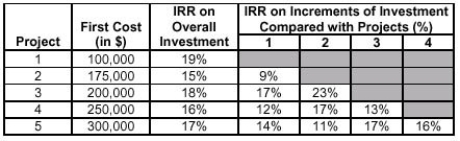

The following table summarizes information for five projects:  The data can be interpreted in the following way: The IRR on the incremental investment between project 5 and project 4 is 16%. If all projects are independent and the company has at least $1 000 000 to invest, which projects should be undertaken if the MARR is 16%?

The data can be interpreted in the following way: The IRR on the incremental investment between project 5 and project 4 is 16%. If all projects are independent and the company has at least $1 000 000 to invest, which projects should be undertaken if the MARR is 16%?

A) only 2

B) 2 and 4

C) 1, 3, and 5

D) 1, 3, 4, and 5

E) 1, 2, 3, 4, and 5

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Dealing with mutually exclusive projects, we start

Q7: The fundamental idea behind comparison of mutually

Q8: If you can invest money at 10%

Q9: When does the problem of multiple IRRs

Q10: A two-year project has $100 million as

Q12: Suppose that you can buy a car

Q13: The external rate of return must be

Q14: Which of the following statements is TRUE

Q15: In general, the IRR comparison method and

Q16: Two mutually exclusive alternatives are being compared.