Multiple Choice

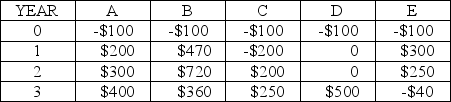

Consider the following investment alternatives:  If MARR is 20%, which one is the best based on PW comparison method?

If MARR is 20%, which one is the best based on PW comparison method?

A) A

B) B

C) C

D) D

E) E

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q35: MMM Consulting is evaluating two oil pumps

Q36: The annual worth method is<br>A)similar to the

Q37: It was discovered by geologists that an

Q38: What is the exact payback period for

Q39: How is the payback period defined and

Q41: A manager is considering two technological lines

Q42: NB Power wants to assess the opportunity

Q43: The minimum acceptable rate of return (MARR)is<br>A)an

Q44: A contingent project is an example of<br>A)independent

Q45: Two mutually exclusive projects with the same