Multiple Choice

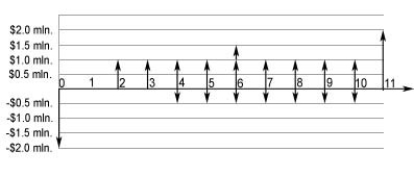

J.D.Irving Ltd. is considering a construction project with $2 million initial investment that will last for 10 years. The duration of the construction phase is one year. Once the construction is over, the project starts yielding a constant annual revenue of $1.0 million. By the end of the fifth year the project generates $0.5 million extra revenue. The annual operation and maintenance expenses of $0.5 million will start at year four and last till the end of the project's life. At the very end of the 10-year project the used equipment can be sold for $1.5 million. What cash flow diagram represents this project?

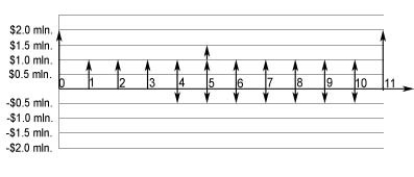

A)

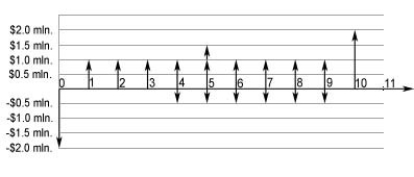

B)

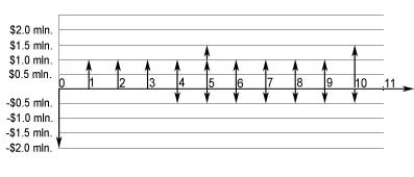

C)

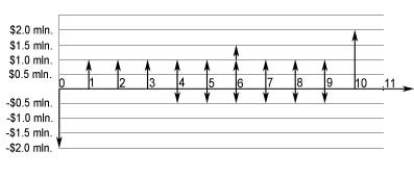

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q55: Milo has just inherited $6 500 and

Q56: Explain why equivalences are just convenient assumptions.

Q58: If the effective equivalent annual interest rate

Q59: The principal amount is<br>A)the present value of

Q61: Two assets, A and B, are purchased

Q61: Two assets, A and B, are purchased

Q62: Bill wants to buy a new car

Q63: What is the major advantage and the

Q64: Suppose that the nominal interest rate is

Q65: If an interest rate is 18% per