Essay

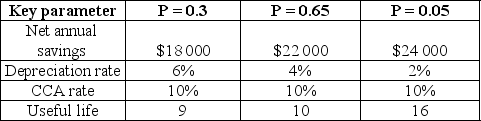

The Kisu Company has just spent $100 000 to install a new technological line to produce kitchen knives. Estimates and probabilities for net annual savings, depreciation rates, CCA rates and useful life are given below:

Kisu pays a 30% corporate tax rate. Calculate the expected value of the annual worth of the line if the after-tax MARR is 10%.

Kisu pays a 30% corporate tax rate. Calculate the expected value of the annual worth of the line if the after-tax MARR is 10%.

Correct Answer:

Verified

Under each outcome the annual worth can ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: The host of a TV show offers

Q31: MMM Consulting is considering three scenarios of

Q32: Suppose you are asked to do a

Q33: If a decision tree shows the possible

Q34: The break-even point is defined as the

Q36: A coal mine extracts 100 000 tons

Q37: Below the results of a scenario analysis

Q38: This decision tree represents the expected profits

Q39: New equipment was bought by an engineering

Q40: A firm's evaluation of all possible alternatives