Essay

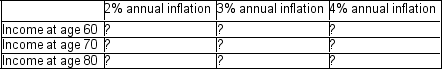

Boris recently turned 30, an event causing him to give thought to some long-range financial planning. He believes that, if he owns a home and is debt-free by age 60, he and his partner can retire and live comfortably on an annual income that is equivalent to $40,000 today. Fill in the cells of the following table with the nominal annual income needed to satisfy this criterion at each age under each of three inflation rate scenarios.

Correct Answer:

Verified

Please rev...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q251: A company borrowed $50,000 at 12% compounded

Q252: A bank offers a four-year "Escalating Rate

Q253: Give two examples of advertisements or news

Q254: Calculate the combined equivalent value of the

Q255: Wojtek purchased a $10,000 face value strip

Q257: Calculate the missing value:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8414/.jpg" alt="Calculate the

Q258: Calculate the combined equivalent value of the

Q259: An investment of $2,500 earned interest at

Q260: What amount today is equivalent to $6,800

Q261: Adel borrowed $6,500, 2 ½ years ago.