Multiple Choice

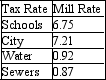

A homeowner's tax statement lists the following mill rates for various municipal services:  The homeowner paid $3937.50 in property taxes last year. What is the assessed value of his property?

The homeowner paid $3937.50 in property taxes last year. What is the assessed value of his property?

A) $264,617

B) $265,509

C) $461,066

D) $250,000

E) $437,500

Correct Answer:

Verified

Correct Answer:

Verified

Q56: Evaluate the answer correct to the

Q174: Evaluate the following:<br> <span class="ql-formula" data-value="\frac{\$

Q310: Evaluate the following accurate to the

Q335: What percent of $950 is $590 accurate

Q336: A manufacturing operation began with 85 staff

Q339: A customer has a first mortgage of

Q341: Jane took six courses last semester. Her

Q342: If the percent Rate is 1,000%, what

Q344: Evaluate <span class="ql-formula" data-value="\frac{\$ 1500\left(1+0.055

Q345: What percent is 88¢ of $44 accurate