Short Answer

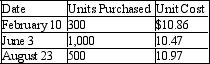

One of the methods permitted by Generally Accepted Accounting Principles for reporting the value of a firm's inventory is weighted-average inventory pricing. The Boswell Corporation began its fiscal year with an inventory of 156 units valued at $10.55 per unit. During the year it made the purchases listed in the following table.

At the end of the year, 239 units remained in inventory. Determine: a) The weighted-average cost of the units purchased during the year. b) The weighted-average cost of the beginning inventory and all units purchased during the year. c) The value of the ending inventory based on the weighted-average cost calculated in b.

Correct Answer:

Verified

a) $10.67

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Evaluate the answer correct to the

Q90: Evaluate the following to the correct

Q126: ...

Q234: 500 grams is what percent of 2.8

Q238: Johnston Distributing, Inc. files quarterly GST returns.

Q240: A piece of property valued at $2,000,000

Q241: Evaluate (25 - 9) ¸ (6 -

Q243: What percent of $5,000 is $675?<br>A) 0.135%<br>B)

Q244: The following fraction has a terminating

Q310: Evaluate the following accurate to the