Essay

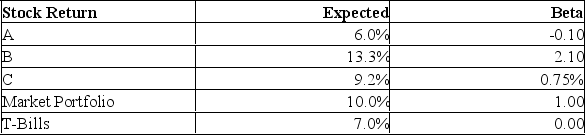

An investor is considering the three stocks given below:

C. Demonstrate that holding stock A actually reduces risk by comparing the risk of a portfolio equally weighted between stock B and T-Bills with a portfolio equally weighted between stock B and

A.

Stock B and C: Rp = .5(13.3%) + .5(9.2%) = 11.25%

Stock B and C: p = .5(2.1) + .5(0.75) = 1.425

Stock B and T-bills: B&TBILL = .5(2.1) + .5(0) = 1.05

Stock's B and A: B&A = .5(2.1) + .5(-0.1) = 1.00

Correct Answer:

Verified

Calculate the expected return and beta o...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: If company A makes a new product

Q3: Which of the following statements is/are true?<br>A)

Q5: You have a 3 factor model

Q7: The betas along with the factors in

Q11: Assume that the single factor APT model

Q11: Based on a multi-factor APT model, the

Q12: Identify at least two accounting measures that

Q13: Suppose that we have identified three

Q44: Explain the conceptual differences in the theoretical

Q50: Suppose the JumpStart Corporation's common stock has