Multiple Choice

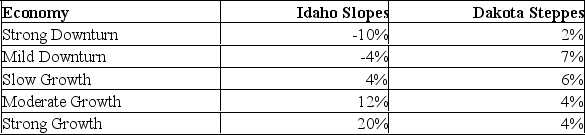

Idaho Slopes (IS) and Dakota Steppes (DS) are both seasonal businesses. IS is a downhill skiing facility, while DS is a tour company that specializes in walking tours and camping. The equally likely returns on each company over the next year is expected to be:  If IS and DS are combined in a portfolio with 50% invested in each, the expected return and risk would be:

If IS and DS are combined in a portfolio with 50% invested in each, the expected return and risk would be:

A) 5.625%; 37.2%.

B) 4.5%; 5.48%.

C) 8.0%; 8.2%.

D) 5.0%; 0%.

E) 4.5%; 0%.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: According to the CAPM,the expected return on

Q7: The total number of variance and covariance

Q10: You want your portfolio beta to be

Q11: Total risk can be divided into:<br>A) standard

Q13: A well-diversified portfolio has negligible:<br>A) expected return.<br>B)

Q14: A portfolio exists containing stocks D, E,

Q16: When many assets are included in a

Q40: Why are some risks diversifiable and some

Q60: We routinely assume that investors are risk-averse

Q105: The opportunity set of portfolios is:<br>A) all