Essay

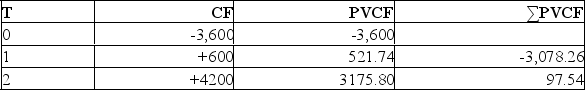

The Walker Landscaping Company can purchase a piece of equipment for $3,600. The asset has a two-year life, will produce a cashflow of $600 in the first year and $4200 in the second year. The interest rate is 15%. Calculate the project's discounted payback and Profitability Index assuming steady cashflows. Should the project be taken? If the accounting rate of return was positive, how would this affect your decision?

Correct Answer:

Verified

DPP = 1 + 3078.26/3175.80 = 1.969 = 1.97...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: A mutually exclusive project is a project

Q47: The discounted payback rule states that you

Q48: The Ziggy Trim and Cut Company can

Q50: You have a choice between two projects,

Q52: Suppose that a project has a cash

Q54: Cutler Compacts will generate cash flows of

Q55: If a project is assigned a required

Q56: The profitability index is the ratio of:<br>A)

Q96: A project has an initial cost of

Q102: The two fatal flaws of the internal