Essay

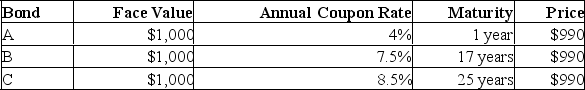

Given the opportunity to invest in one of the three bonds listed below, which would you purchase? Assume an interest rate of 7%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Mortgage Instruments Inc. is expected to pay

Q2: Show that a firm with earnings of

Q4: In the above example, the price of

Q5: Suppose that an investor disagrees with market

Q8: The market rate of interest on 2

Q9: Zeta Corporation has issued a $1,000 face

Q10: Consider a bond which pays 7% semi-annually

Q11: The discount rate can be thought of

Q21: Angelina's made two announcements concerning its common

Q53: Your firm offers a 10-year,zero coupon bond.