Multiple Choice

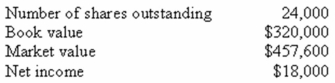

The Metallica Heavy Metal Mining (MHMM) Corporation wants to diversify its operations.Some recent financial information for the company is shown here:  MHMM is considering an investment that has the same P/E ratio as the firm.The cost of the investment is $800,000, and it will be financed with a new equity issue.What would the ROE on the investment have to be if we wanted the price after the offering to be $115 per share? Assume the PE ratio remains constant.

MHMM is considering an investment that has the same P/E ratio as the firm.The cost of the investment is $800,000, and it will be financed with a new equity issue.What would the ROE on the investment have to be if we wanted the price after the offering to be $115 per share? Assume the PE ratio remains constant.

A) 18.28 percent

B) 21.41 percent

C) 27.63 percent

D) 37.27 percent

E) 40.03 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Barstow Industrial Supply has decided to raise

Q15: What is an issue of securities that

Q17: Atlas Corp.wants to raise $4 million via

Q28: Bakers' Town Bread is selling 1,200 shares

Q49: The difference between the underwriters' cost of

Q51: With firm commitment underwriting, the issuing firm:<br>A)

Q62: Executive Tours has decided to take its

Q66: The stock of Cleaner Home Products is

Q78: Pearson Electric recently registered 250,000 shares of

Q92: The value of a right depends upon:<br>I.the