Multiple Choice

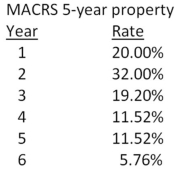

Keyser Petroleum just purchased some equipment at a cost of $67,000.What is the proper methodology for computing the depreciation expense for year 2 if the equipment is classified as 5-year property for MACRS?

A) $67,000 × (1 - 0.20) × 0.32

B) $67,000/(1 - 0.20 - 0.32)

C) $67,000 × (1 + 0.32)

D) $67,000 × (1 - 0.32)

E) $67,000 × 0.32

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Bi-Lo Traders is considering a project that

Q3: Three years ago,Knox Glass purchased a machine

Q13: The depreciation tax shield is best defined

Q24: Jasper Metals is considering installing a new

Q52: Cool Comfort currently sells 300 Class A

Q60: Which one of the following would make

Q72: Phone Home,Inc.is considering a new 4-year expansion

Q82: In a single sentence,explain how you can

Q82: Consider the following income statement: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg"

Q108: The net book value of equipment will:<br>A)remain