Multiple Choice

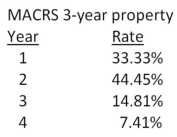

Peterborough Trucking just purchased some fixed assets that are classified as 3-year property for MACRS.The assets cost $10,600.What is the amount of the depreciation expense in year 3?

A) $537.52

B) $1,347.17

C) $1,569.86

D) $1,929.11

E) $2,177.56

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: Pro forma statements for a proposed project

Q13: The Lumber Yard is considering adding a

Q25: Increasing which one of the following will

Q28: Dog Up! Franks is looking at a

Q29: Winnebagel Corp.currently sells 28,200 motor homes per

Q42: Morris Motors just purchased some MACRS 5-year

Q50: Marie's Fashions is considering a project that

Q54: Kelly's Corner Bakery purchased a lot in

Q62: A 4-year project has an initial asset

Q86: The fact that a proposed project is