Multiple Choice

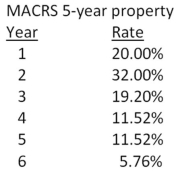

You own some equipment that you purchased 4 years ago at a cost of $225,000.The equipment is 5-year property for MACRS.You are considering selling the equipment today for $87,000.Which one of the following statements is correct if your tax rate is 35 percent?

A) The tax due on the sale is $26,425.

B) The book value today is $186,120.

C) The accumulated depreciation to date is $38,880.

D) The taxable amount on the sale is $38,880.

E) The aftertax salvage value is $70,158.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Keyser Mining is considering a project that

Q17: All of the following are related to

Q21: Which one of the following statements is

Q37: Danielle's is a furniture store that is

Q47: The equivalent annual cost considers which of

Q61: Sailcloth & More currently produces boat sails

Q65: Which one of the following is a

Q66: Crafter's Supply purchased some fixed assets 2

Q81: A project will produce an operating cash

Q100: Assume a firm sets its bid price