Multiple Choice

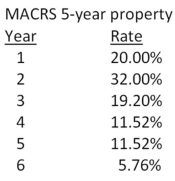

Edward's Manufactured Homes purchased some machinery 2 years ago for $319,000.These assets are classified as 5-year property for MACRS.The company is replacing this machinery today with newer machines that utilize the latest in technology.The old machines are being sold for $140,000 to a foreign firm for use in its production facility in South America.What is the aftertax salvage value from this sale if the tax rate is 35 percent?

A) $135,408

B) $140,000

C) $142,312

D) $144,592

E) $146,820

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Increasing which one of the following will

Q27: Phone Home,Inc.is considering a new 6-year expansion

Q28: Dog Up! Franks is looking at a

Q34: Keyser Mining is considering a project that

Q42: Morris Motors just purchased some MACRS 5-year

Q50: Marie's Fashions is considering a project that

Q54: Kelly's Corner Bakery purchased a lot in

Q57: The current book value of a fixed

Q91: Gateway Communications is considering a project with

Q107: Consider a project to supply 60,800,000 postage