Multiple Choice

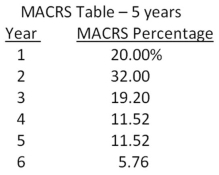

Chapman Machine Shop is considering a 4-year project to improve its production efficiency.Buying a new machine press for $576,000 is estimated to result in $192,000 in annual pretax cost savings.The press falls in the MACRS 5-year class, and it will have a salvage value at the end of the project of $84,000.The press also requires an initial investment in spare parts inventory of $24,000, along with an additional $3,600 in inventory for each succeeding year of the project.The inventory will return to its original level when the project ends.The shop's tax rate is 35 percent and its discount rate is 11 percent.Should the firm buy and install the machine press? Why or why not?

A) no; The net present value is -$7,489.

B) no; The net present value is -$667.

C) yes; The net present value is $211.

D) yes; The net present value is $4,319.

E) yes; The net present value is $8,364.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Nelson Mfg.owns a manufacturing facility that is

Q12: Pro forma statements for a proposed project

Q13: The Lumber Yard is considering adding a

Q14: Kwik 'n Hot Dogs is considering the

Q29: Winnebagel Corp.currently sells 28,200 motor homes per

Q62: A 4-year project has an initial asset

Q66: What is the primary purpose of computing

Q86: The fact that a proposed project is

Q101: A company that utilizes the MACRS system

Q104: Consider an asset that costs $176,000 and