Multiple Choice

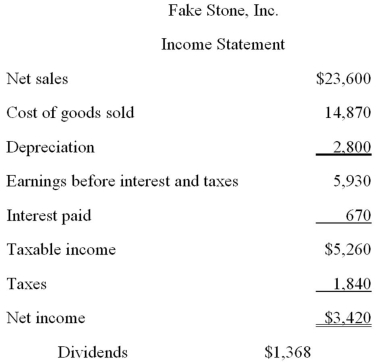

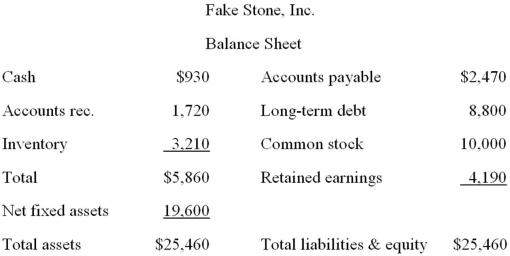

Assume that Fake Stone, Inc.is operating at full capacity.Also assume that all costs, net working capital, and fixed assets vary directly with sales.The debt-equity ratio and the dividend payout ratio are constant.What is the pro forma net fixed asset value for next year if sales are projected to increase by 7.5 percent?

A) $19,800

B) $21,070

C) $23,600

D) $24,240

E) $26,810

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Which one of the following capital intensity

Q28: Financial planning:<br>A)focuses solely on the short-term outlook

Q33: The Cookie Shoppe expects sales of $437,500

Q41: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Major

Q42: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Assume

Q47: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Major

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Hungry

Q67: Which one of the following correctly defines

Q74: A firm wishes to maintain a growth

Q79: Financial planning accomplishes which of the following