Multiple Choice

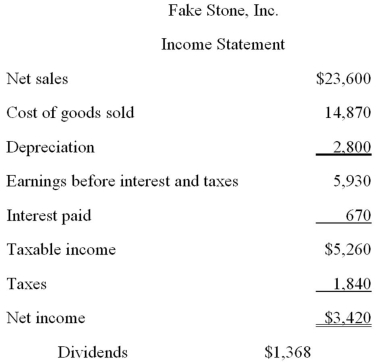

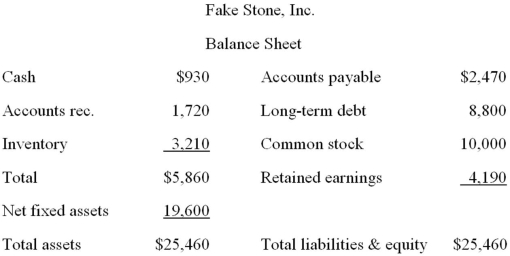

Assume that Fake Stone, Inc.is operating at full capacity.Also assume that assets, costs, and current liabilities vary directly with sales.The dividend payout ratio is constant.What is the external financing need if sales increase by 12 percent?

A) -$318.09

B) -$268.49

C) $103.13

D) $350.40

E) $460.56

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which one of the following is correct

Q30: The Two Sisters has a 9 percent

Q31: The financial planning process:<br>I.involves internal negotiations among

Q41: Monika's Dinor is operating at 94 percent

Q48: Frasier Cabinets wants to maintain a growth

Q55: What is the sustainable growth rate assuming

Q61: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Hungry

Q63: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Hungry

Q73: Which of the following are needed to

Q77: Which one of the following statements is