Multiple Choice

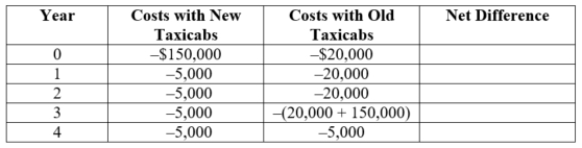

(Table: Taxi Fleet) Metro Cab is considering replacement of its fleet of old taxicabs. To replace its fleet, Metro must spend $150,000 on new taxicabs. The new taxis will incur $5,000 of maintenance expenses per year. Alternatively, Metro could spend $20,000 today to refurbish its taxicabs and incur an additional $20,000 per year of maintenance expenses for the next three years. Metro would then have to buy new taxicabs for $150,000 at the end of three years, leading to lower maintenance expenses of $5,000 per year.  Using an interest rate of 10%, the net present value of the first three years is $____.

Using an interest rate of 10%, the net present value of the first three years is $____.

A) 65,000

B) 37,272.73

C) 20,000

D) 195,000

Correct Answer:

Verified

Correct Answer:

Verified

Q77: You've won a radio contest that gives

Q78: The demand for capital is Q<sup>D</sup> =

Q79: A corporate bond has a $10,000 face

Q80: The demand for capital is Q<sup>D</sup> =

Q81: Sam is considering the purchase of a

Q83: Suppose that a firm generates $40,000 of

Q84: Qing and her coworkers like to bet

Q85: (Table Cash Flows I) At a 7%

Q86: (Table: Health Status) Suppose the person's utility

Q87: A change in household tastes and preferences