Multiple Choice

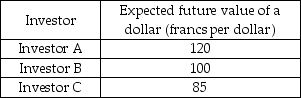

-Using the table above, if the current market value of the dollar is 125 francs per dollar

A) investor A expects dollar appreciation, but B and C expect depreciation.

B) investor A expects dollar depreciation, but B and C expect appreciation.

C) all three investors expect the dollar to appreciate.

D) all three investors expect the dollar to depreciate.

Correct Answer:

Verified

Correct Answer:

Verified

Q115: Adjusted for risk, interest rate parity<br>A) holds

Q116: If the current account has a negative

Q117: Which of the following is included in

Q118: Over the past decade, the United States

Q119: If the Fed wants to depreciate the

Q121: In 2007, the U.S. sold $73 million

Q122: When the U.S. exchange rate rises and

Q123: The U.S. dollar will depreciate in value

Q124: Which of the following statements is CORRECT?<br>I.

Q125: When the U.S. government buys aircraft from