Multiple Choice

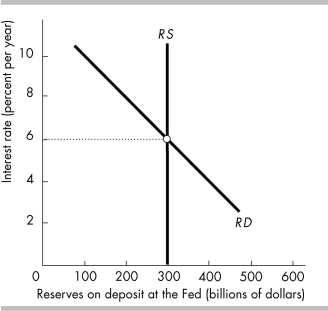

-The figure above shows the market for bank reserves in Futureland. If the Bank of Futureland undertakes an open market sale of government securities that changes the quantity of reserves by $100 billion and the federal funds rate remains within the corridor, then the federal funds rate will

A) rise to 8 percent a year.

B) remain at 6 percent a year.

C) fall to 4 percent a year.

D) None of the above answers is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q189: The higher the federal funds rate, the

Q190: "As the Fed Chases Inflation, Critics Shout,

Q191: The financial regulation to lower the risk

Q192: Consumer confidence in the economy rises, and

Q193: When the output gap is positive, it

Q195: When the Federal Reserve fights recession via

Q196: In September 2012 the Fed announced that

Q197: When the Fed purchases U.S. government securities

Q198: When would the Fed want to carry

Q199: If the U.S. interest rate rises, the