Multiple Choice

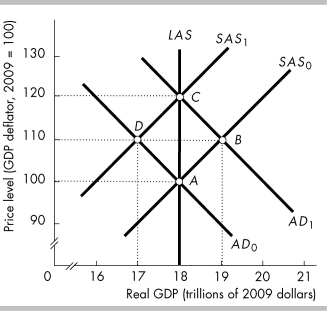

-In the above figure, if the economy is initially at point D, then if the Fed lowers the federal funds rate

A) the supply of loanable funds decreases, the real interest rate falls, and the AD curve shifts rightward.

B) other short-term interest rates fall, net exports increase, and the AD curve shifts rightward.

C) the exchange rate rises, investment increases, and the SAS curve shifts rightward.

D) the demand for loanable fund and supply of loanable funds both increase by the same amount so that the AD curve shifts rightward.

Correct Answer:

Verified

Correct Answer:

Verified

Q135: Describe how open market operations change the

Q136: In the short run, a rise in

Q137: A decrease in the federal funds rate<br>A)

Q138: When the Fed lowers the federal funds

Q139: In 2016, the federal funds rate was

Q141: In the short run, the Federal Reserve

Q142: In September 2012 unemployment was high and

Q143: A decrease in the supply of loanable

Q144: Explain the ripple effects of a sale

Q145: Long-term interest rates fluctuate _ short-term interest