Multiple Choice

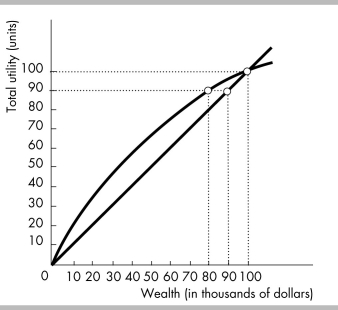

-Bruce Copperwood's utility of wealth curve is illustrated in the above figure. Bruce is presently employed at a salary of $100,000. There is a 10 percent probability that Bruce will be totally disabled, in which case he will have no wealth. An insurance company (with no operating expenses) would be willing to offer Bruce a disability insurance policy paying $100,000 in the case of total disability for a minimum premium of

A) $1,000.

B) $10,000.

C) $20,000.

D) $90,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q52: Insurance can be profitable when it<br>A) eliminates

Q53: If a lender checks credit reports on

Q54: A risk averse person will always buy

Q55: If a salesperson is paid by the

Q56: If Pearl is a risk averse, then<br>A)

Q58: Insurance companies charge a lower premium to

Q59: Insurance companies<br>A) pool risk and thereby lower

Q60: What is expected utility?

Q61: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Steve owns a

Q62: In the health insurance market, moral hazard