Multiple Choice

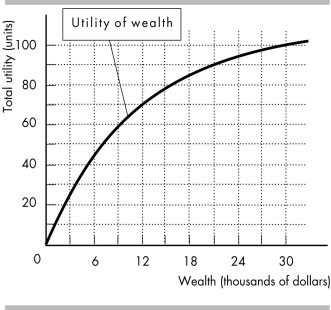

-Andrew has the utility of wealth curve shown in the above figure. He owns an SUV worth $30,000 and that is his only wealth. There is a 10 percent chance that he will have an accident within a year. If he does have an accident, his SUV is worthless. Suppose all SUV owners are like Andrew. An insurance company agrees to pay each person who has an accident the full value of his/her SUV. The company's operating expenses are $1,500. What is the minimum insurance premium that the company is willing to accept?

A) $1,500 per year

B) $4,500 per year

C) $3,000 per year

D) $6,000 per year

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Erika's utility with $3,000 of wealth is

Q13: Moral hazard occurs when an agreement encourages

Q14: For a risk-averse individual, as wealth increases,

Q15: Nicole is indifferent between option A, which

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Bruce Copperwood's utility

Q18: Private information is a situation in which<br>A)

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Steve owns a

Q20: There is a growing market for buying

Q21: The assumption that the marginal utility of

Q22: In the market for automobile insurance, adverse