Multiple Choice

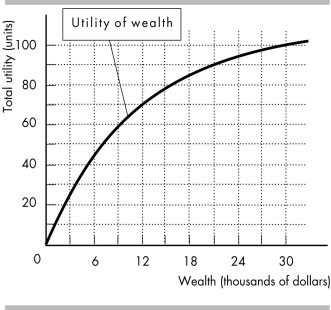

-Ashton has the utility of wealth curve shown in the above figure. He owns a sports car worth $30,000, and that is his only wealth. Ashton is a careless driver and there is a 30 percent chance that he will have an accident within a year. If he does have an accident, his car is worthless. Suppose all sports cars owners are like Ashton. An insurance company agrees to pay each person who has an accident the full value of their car. The company's operating expenses are $1,000. Ashton will ________ the company's policy because the minimum premium for such insurance that the company is willing to accept is ________ the maximum premium Ashton is willing to pay.

A) buy; by $1,500 lower than

B) buy; the same as

C) not buy; $1,500 higher than

D) not buy; $1,000 higher than

Correct Answer:

Verified

Correct Answer:

Verified

Q219: If reckless drivers are more likely than

Q220: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -James has a

Q221: Most college professors are granted tenure after

Q222: Which of the following statements is CORRECT?<br>A)

Q223: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -In the figure

Q225: A major function of incentive payments, guarantees,

Q226: If you have private information that you

Q227: Moral hazard occurs because people act<br>A) in

Q228: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Ashton has the

Q229: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -The above figure