Essay

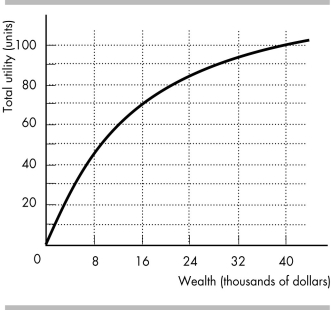

-Roy owns a sports car worth $40,000, and that is his only wealth. Roy is a reckless driver, and there is a 30 percent chance that he will have an accident within a year. If he does have an accident, his car is worthless. Roy's utility of wealth curve is shown in the figure below. An insurance company agrees to pay a car owner like Roy the full value of his car in case of an accident if the car owner buys the company's insurance policy. The company's operating expenses are $2,000 per policy.

a) What is Roy's expected wealth?

b) What is Roy's expected utility?

c) What is the maximum amount that Roy is willing to pay for car insurance?

d) What is the minimum premium that the insurance company is willing to accept?

e) Will Roy buy the insurance policy? Why or why not?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -James has a

Q2: Expected wealth is a weighted average in

Q4: Joe is contemplating a job where, with

Q5: When Sardar buys insurance, on net he<br>A)

Q6: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -John's utility of

Q7: In the used car market, adverse selection

Q8: Warranties in the used car market _

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Beachcomber Beatrice spent

Q10: A risk-averse person's marginal utility of wealth<br>A)

Q11: One way of reducing the moral hazard