Multiple Choice

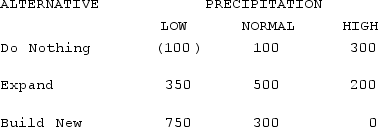

The operations manager for a well-drilling company must recommend whether to build a new facility, expand his existing one, or do nothing. He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows:

If he feels the chances of low, normal, and high precipitation are 30 percent, 20 percent, and 50 percent respectively, what are expected long-run profits for the alternative he will select?

A) $140,000

B) $170,000

C) $285,000

D) $305,000

E) $475,000

Correct Answer:

Verified

Correct Answer:

Verified

Q94: The construction manager for Acme Construction, Inc.,

Q95: The first, and perhaps most important, step

Q96: Which of the following is a key

Q97: The method of financial analysis which focuses

Q98: The operations manager for a local bus

Q100: A Virginia county is considering whether to

Q101: Efficiency is defined as the ratio of:<br>A)actual

Q102: Capacity in excess of expected demand that

Q103: The Laplace criterion treats states of nature

Q104: If the minimum expected regret is computed,