Multiple Choice

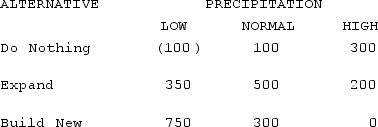

The operations manager for a well-drilling company must recommend whether to build a new facility, expand his existing one, or do nothing. He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows:

If he feels the chances of low, normal, and high precipitation are 30 percent, 20 percent, and 50 percent respectively, what is his expected value of perfect information?

A) $140,000

B) $170,000

C) $285,000

D) $305,000

E) $475,000

Correct Answer:

Verified

Correct Answer:

Verified

Q183: Consider the following decision scenario:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8594/.jpg" alt="Consider

Q184: Everything else being equal, a firm considering

Q185: Departmentalizing decisions increases the risk of _

Q186: Capacity decisions often involve a long-term commitment

Q187: The owner of a greenhouse and nursery

Q189: The head of operations for a movie

Q190: The range of probability for which an

Q191: Among decision environments, uncertainty implies that states

Q192: The new owner of a beauty shop

Q193: The construction manager for Acme Construction, Inc.,