Multiple Choice

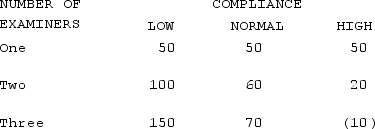

The local operations manager for the Internal Revenue Service must decide whether to hire one, two, or three temporary tax examiners for the upcoming tax season. She estimates that net revenues (in thousands of dollars) will vary with how well taxpayers comply with the new tax code just passed by Congress, as follows:

If she feels the chances of low, medium, and high compliance are 20 percent, 30 percent, and 50 percent respectively, what are the expected net revenues for the number of assistants she will decide to hire?

A) $26,000

B) $46,000

C) $48,000

D) $50,000

E) $76,000

Correct Answer:

Verified

Correct Answer:

Verified

Q129: The head of operations for a movie

Q130: Which phrase best describes the term "bounded

Q131: The owner of a greenhouse and nursery

Q132: Capacity cushion can be determined by:<br>A)capacity −

Q133: Improving cash flow would be a reasonable

Q135: Which of the following is not a

Q136: If the output rate is increased but

Q137: A weakness of the maximin approach is

Q138: Increasing capacity just before a bottleneck operation

Q139: Seasonal variations are often easier to deal