Essay

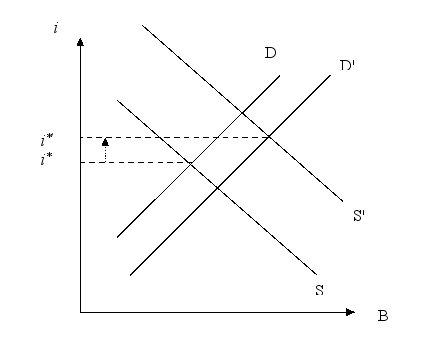

A tax cut is funded by an increase in the deficit. On a graph of bond supply and demand, show and explain how this policy could lead to higher interest rates.

Correct Answer:

Verified

A tax cut shifts the demand for bonds to...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

A tax cut shifts the demand for bonds to...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q26: The high nominal yields in the 1990s

Q27: A decrease in the money supply leads

Q28: Which of the following affects both the

Q29: An economic expansion can lead to higher

Q30: Show the impact of a decrease in

Q32: If the economy goes into a recession,

Q33: Nominal bond yields peaked during the Great

Q34: The supply of bonds shifts to the

Q35: The supply of bonds increases with the

Q36: A change in expected inflation affects both