Multiple Choice

Use the following to answer questions .

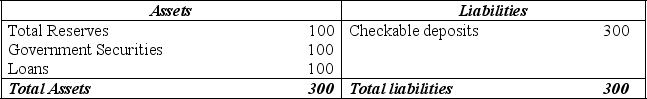

Exhibit: Reserves, Loans, and Money

-(Exhibit: Reserves, Loans, and Money) If the required reserve ratio is 10% and the market interest rate is 8%, what is Bolton Bank's opportunity cost of holding the excess reserves it is currently holding?

A) $5.6 million

B) $3.2 million

C) $0.8 million

D) 0; Bolton Bank has no excess reserves.

Correct Answer:

Verified

Correct Answer:

Verified

Q198: Decreasing the reserve requirement ratio is<br>A) a

Q199: The Federal Reserve influences the level of

Q200: Suppose the Fed sells $1,000 of government

Q201: Which of the following equations is correct?<br>A)

Q202: What is the value of the deposit

Q204: Use the following to answer questions .<br>Exhibit:

Q205: Use the following to answer questions .<br>Exhibit:

Q206: The three main monetary policy instruments are<br>A)

Q207: The Fed conducts an open market purchase

Q208: The price of an iPhone 7 is