True/False

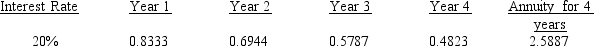

For a project that has an initial outflow of $10 000 and equal inflows of $3400 for four years, the NPV at a minimum rate of return of 20% will be ($1198) and should not be accepted.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q44: Which of the following best expresses the

Q45: Describe the major disadvantages of using the

Q46: Harglo Construction is considering purchasing a radio

Q47: What is the average annual accounting rate

Q48: The payback period is a method used

Q50: For mutually exclusive projects, the IRR and

Q51: Which of the following is not an

Q52: The Sloppy Jeans Company is considering the

Q53: The Orgonne Milling Company is contemplating the

Q54: Using the tables provided, calculate the IRR