Multiple Choice

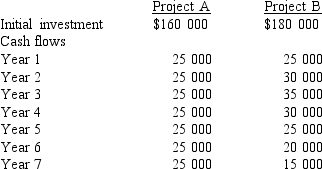

Ridge NL is considering investing in a new project. Given the following information, which project would Ridge choose if a maximum payback period of 5.8 years is set?

A) Project B, as the payback period is less than 5.8 years.

B) Both projects, as the payback periods are less than 5.8 years.

C) Project A, as the payback period is less than 5.8 years.

D) Neither project, as both payback periods exceed 5.8 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Which of the following statements is true

Q15: The accounting rate of return (ARR) is

Q16: An alternative approach to using the algebraic

Q17: Capital investment decisions include mutually exclusive projects

Q18: Which of the following statements is true

Q20: If you placed $1000 in a savings

Q21: The payback period provides some assessment of

Q22: Which of the following does not affect

Q23: An entity is contemplating investing in a

Q24: Which of the following formulas would you