Essay

The Tearess Company can accept either Proposal A or Proposal B (but not both), or it can reject both investment proposals. Proposal A requires an investment of $7000 and promises increased net cash inflows of $2600 for five years. Proposal B requires an investment of $7000 and promises increased net cash inflows of $3000 in each of the first three years, $2000 in the fourth year and $2200 in the fifth year. The company's minimum acceptable rate of return is 20%.

Prepare an analysis to determine which (if either) of the proposals should be selected for investment.

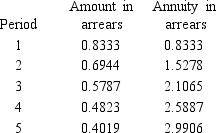

Discount factors for 20%:

Correct Answer:

Verified

Investment Proposal A

There...

There...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: The Sloppy Jeans Company is considering the

Q53: The Orgonne Milling Company is contemplating the

Q54: Using the tables provided, calculate the IRR

Q55: An entity is contemplating investing in a

Q56: Which of the following is not an

Q58: Describe the accounting rate of return (ARR)

Q59: A series of equal amounts received or

Q60: What is an advantage of the payback

Q61: What is a disadvantage of using the

Q62: A company is considering two projects with