Multiple Choice

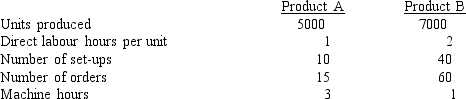

Java Ltd manufactures two products, A and B. The manufacturing processes for the two products are very similar. The following are excerpts from the product data for these two products for this year:  Overhead costs total $285 000.

Overhead costs total $285 000.

What is the cost per unit for each of A and B in respect of overhead costs using absorption costing, if costs are absorbed on the basis of direct labour hours?

A) $15 and $30

B) $1 and $2

C) $16.96 and $23.75

D) $38.86 and $12.95

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Absorption costing is a method of allocating

Q47: A dependent variable represents the cost of

Q48: Absorption costing would be based on which

Q49: Veronica's Clothing Manufacturers supplies the following information.

Q50: When sales exceeds production, absorption costing shows

Q52: Indirect costs are not included in the

Q53: Adel Department Store incurred $8000 of indirect

Q54: The overhead absorption rate is determined by

Q55: Discounts, increased prices and diminishing returns are

Q56: Costs that would be included in the