Essay

On 1 January, the Harglo Construction Company leased a bulldozer from ASIS Sales Corporation. The lease meets the criteria for classification as a finance (capital) lease and requires Harglo to make annual payments of $30 000 at the end of each of the next 10 years with the first payment due at the end of each year on 31 December. The present value of the lease payments is $200 000 based on an interest rate of 8%.

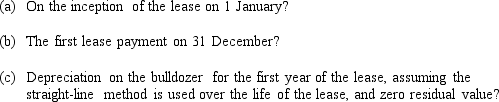

How would the lessee record:

Correct Answer:

Verified

Correct Answer:

Verified

Q54: Which of the following statements is incorrect?<br>A)

Q55: AKP Ltd uses the accrual-basis method of

Q56: Accounting for income tax gives rise to

Q57: The operating net profit before income tax

Q58: Which of the following must be known

Q60: The sources of equity finance for a

Q61: The following is an excerpt from a

Q62: Which type of shares has a higher

Q63: If taxable income is $220 000, accounting

Q64: Raffles Ltd began the financial year on